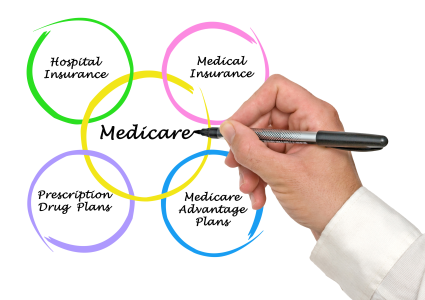

Medicare

Medicare provides health insurance for Americans age 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration, as well as people with end stage renal disease and amyotrophic lateral sclerosis (ALS). It is funded by payroll tax premiums and surtaxes from beneficiaries, and general revenue.

Medicare provides health insurance for Americans age 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration, as well as people with end stage renal disease and amyotrophic lateral sclerosis (ALS). It is funded by payroll tax premiums and surtaxes from beneficiaries, and general revenue.

If you are close to 65 but not receiving Social Security or Railroad Retirement Board benefits, you will need to sign up for Medicare. The initial enrollment period for Medicare is the 3 months before your birthday, the month of your birthday and the 3 months after your birthday. Enrollment outside of the initial enrollment period could result in penalties. Contact Social Security to enroll, preferably 3 months before your birthday.

Medicare consists of 4 parts

Part A (hospital insurance) coverage is premium-free if you or your spouse paid Medicare taxes while working. If you aren't eligible for premium-free, you may be able to buy Part A. In most cases, if you buy Part A, you must also have Part B and will pay monthly premiums for both. Part A helps cover:

- Inpatient care in a hospital

- Inpatient care in a skilled nursing facility (not custodial or long-term care)

- Hospice care

- Home health care

- Inpatient care in a religious nonmedical health care institution

Part B (medical insurance). There are monthly premiums for Part B. Premiums can be higher if you are in a higher income bracket. There is a late enrollment penalty of 10% for every 12 months that you were eligible but did not sign up. An exception would be if you have coverage or are covered by a spouse through a group health plan based on current employment, you may be able to delay enrolling in Part B and won't have to pay a lifetime late enrollment penalty if you enroll later. However, the size of your employer determines whether you are able to delay enrollment without penalty. Part B helps cover:

- Medically necessary doctor's services, outpatient care, home health services, durable medical equipment, and other medical services including many preventive services

Part C (Medicare Advantage Plan) is an alternative way to receive your Medicare coverage. You must have both Part A and Part B and you will receive this coverage through a Medicare Advantage Plan and not Original Medicare. Medicare Advantage Plans (MA) are offered through Medicare-approved private companies that must follow rules set by Medicare. Medicare Advantage Plans may offer extra coverage, like vision, hearing, dental, and other health and wellness programs. Most plans include Medicare prescription drug coverage (Part D). In addition to your Part B premium, you may have to pay a monthly premium for the Medicare Advantage Plan. Different types of Medicare Advantage Plans are:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS) plans

- Special Needs Plans (SNP)

- HMO Point-of-Service (HMOPOS) plans

- Medical Savings Account (MSA) plans

Part D (Prescription Drug Coverage) is offered to everyone with Medicare. This coverage is offered through Medicare-approved private companies. There is a monthly premium for prescription drug coverage and it can be higher if you fall into a higher income bracket. Even if you don't take prescriptions now, you should consider joining a Medicare drug plan. If you do not join when first eligible and you don't have other creditable prescription drug coverage or receive Extra Help*, you will be faced with a late enrollment penalty. In most cases, you will pay this penalty for as long as you have Medicare prescription drug coverage. You must have Parts A and B to join a Medicare Prescription Drug Plan. You can receive your coverage 2 ways:

- Medicare Prescription Drug Plans (PDP) coverage added to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service (PFFS) plans, and Medicare Medical Savings Account (MSA) plans

- Medicare Advantage Plans (like HMO or PPO) or other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A, Part B and Part D through these plans. Medicare Advantage Plans that include prescription drug coverage are often referred to as MA-PD

*Extra Help is a Medicare program to help people with limited income and resources pay for Medicare prescription drug costs.

Medicaid

Medicaid is a joint federal and state program that pays for health care, behavioral health and long term services and supports for people with limited incomes and assets who meet eligibility requirements. Some people qualify for both Medicare and Medicaid and are called 'dual eligibles.' If you have Medicare and full Medicaid coverage, most of your health care costs are covered.

Medicaid is a joint federal and state program that pays for health care, behavioral health and long term services and supports for people with limited incomes and assets who meet eligibility requirements. Some people qualify for both Medicare and Medicaid and are called 'dual eligibles.' If you have Medicare and full Medicaid coverage, most of your health care costs are covered.

The Medicaid program is administered by the local Department of Social Services in the city or county where you live.

For more information about Medicaid eligibility and coverage in Virginia, including how to apply, go to www.coverva.org.

There are four easy ways to apply for Medicaid:

- Call Cover Virginia at 1-855-242-8282 to apply on the phone Mon - Fri: 8:00 am to 7:00 pm and Sat: 9:00 am to 12:00 pm

- Apply online at www.commonhelp.virginia.gov

- Print out and complete a paper application (Spanish version available here) and mail it to your local Department of Social Services

- Visit your local Department of Social Services in the city or county in which you live.

You should have the following information ready when you apply:

- Full legal name, Date of Birth, Social Security Number, Citizenship or Immigration Status for you and anyone in your household who is applying for health care coverage.

- Most recent federal tax filing information (if available).

- Job and income information for members of your household for the month prior or the current month. Having recent pay stubs or W-2s to reference may be helpful.

- Information about other taxable income for members of your household such as unemployment benefits, Social Security benefits, pensions, retirement income, rental income, alimony received, etc.